Difference between revisions of "Intrinsic value"

(→Definitions) |

|||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

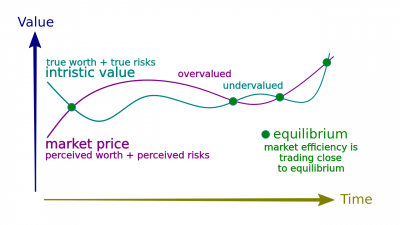

| − | [[Intrinsic value]] (alternatively known as [[fundamental value]]), ''P^<small>0</small>'', is the present value of a firm's expected future free cash | + | [[File:Intristic-vs-market.png|400px|thumb|right|[[Intrinsic value]] vs [[market price]]]][[Intrinsic value]] (alternatively known as [[fundamental value]]), ''P^<small>0</small>'', is the present value of a firm's expected future [[free cash flow]]s. |

Latest revision as of 00:35, 3 November 2019

Intrinsic value (alternatively known as fundamental value), P^0, is the present value of a firm's expected future free cash flows.

Definitions

According to Financial Management Theory and Practice by Eugene F. Brigham and Michael C. Ehrhardt (13th edition),

- Intrinsic value (fundamental value), P^0. The present value of a firm's expected future free cash flows.

According to Fundamentals of Financial Management by Eugene F. Brigham and Joel F. Houston (15th edition),

- Intrinsic value. An estimate of a stock's "true" value based on accurate risk and return data. The intrinsic value can be estimated, but not measured precisely.

Related concepts

- Financial management. A combination of enterprise efforts undertaken in order to procure and utilize monetary resources of the enterprise.