Difference between revisions of "S corporation"

(→Definitions) |

|||

| Line 1: | Line 1: | ||

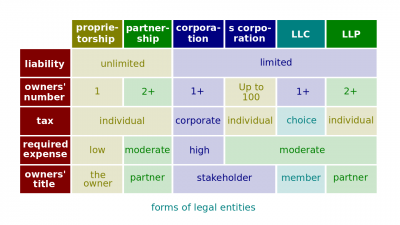

| − | [[S corporation]] is a small corporation that, under Subchapter S of the Internal Revenue Code, elects to be taxed as a proprietorship or a partnership yet retains limited liability and other benefits of the corporate form of organization. | + | [[File:Org-forms.png|400px|thumb|right|[[Legal organizational entity]]]][[S corporation]] is a small corporation that, under Subchapter S of the Internal Revenue Code, elects to be taxed as a proprietorship or a partnership yet retains limited liability and other benefits of the corporate form of organization. |

Revision as of 10:17, 3 November 2019

S corporation is a small corporation that, under Subchapter S of the Internal Revenue Code, elects to be taxed as a proprietorship or a partnership yet retains limited liability and other benefits of the corporate form of organization.

Definitions

According to Financial Management Theory and Practice by Eugene F. Brigham and Michael C. Ehrhardt (13th edition),

- S corporation. A small corporation that, under Subchapter S of the Internal Revenue Code, elects to be taxed as a proprietorship or a partnership yet retains limited liability and other benefits of the corporate form of organization.

According to Fundamentals of Financial Management by Eugene F. Brigham and Joel F. Houston (15th edition),

- S corporation. A special designation that allows small businesses that meet qualifications to be taxed as if they were a proprietorship or a partnership rather than a corporation.

Related concepts

- Financial management. A combination of enterprise efforts undertaken in order to procure and utilize monetary resources of the enterprise.