Difference between revisions of "Independent contractor"

| Line 1: | Line 1: | ||

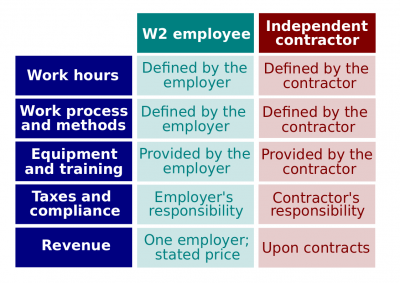

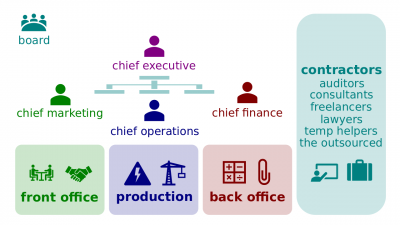

| − | [[File:Contracting.png|400px|thumb|right|[[Independent contractor]]]][[File:Employee-vs-contractor.png|400px|thumb|right|[[Independent contractor]] vs [[employee]]]][[File:Org-struct.png|400px|thumb|right|[[Functional structure]]]]An [[independent contractor]] (in the [[United States]], also known as a [[1099-form worker]]; hereinafter, the ''Contractor'') is a [[contractor]], who is an [[individual]] who provides | + | [[File:Contracting.png|400px|thumb|right|[[Independent contractor]]]][[File:Employee-vs-contractor.png|400px|thumb|right|[[Independent contractor]] vs [[employee]]]][[File:Org-struct.png|400px|thumb|right|[[Functional structure]]]]An [[independent contractor]] (in the [[United States]], also known as a [[1099-form worker]]; hereinafter, the ''Contractor'') is a [[contractor]], who is an [[individual]] and who provides another [[legal entity]] with his or her [[product]]s, usually, [[service]]s. The ''Contractor's products'' are specified under terms of a [[contract]] or a verbal agreement. |

The ''Contractor'' is also a legal term that the [[Internal Revenue Service]] ([[IRS]]) utilizes in order to distinguish the ''Contractors'' from [[employee]]s. Unlike an [[employee]], the ''Contractor'' does not work regularly for an [[employer]], but works as and when required, during which time he or she may be subject to law of agency. The ''Contractors'' are usually paid on a freelance basis. The ''Contractors'' often work through a limited company or franchise, which they themselves own, or may work through an umbrella organization. | The ''Contractor'' is also a legal term that the [[Internal Revenue Service]] ([[IRS]]) utilizes in order to distinguish the ''Contractors'' from [[employee]]s. Unlike an [[employee]], the ''Contractor'' does not work regularly for an [[employer]], but works as and when required, during which time he or she may be subject to law of agency. The ''Contractors'' are usually paid on a freelance basis. The ''Contractors'' often work through a limited company or franchise, which they themselves own, or may work through an umbrella organization. | ||

Revision as of 03:59, 18 April 2020

An independent contractor (in the United States, also known as a 1099-form worker; hereinafter, the Contractor) is a contractor, who is an individual and who provides another legal entity with his or her products, usually, services. The Contractor's products are specified under terms of a contract or a verbal agreement.

The Contractor is also a legal term that the Internal Revenue Service (IRS) utilizes in order to distinguish the Contractors from employees. Unlike an employee, the Contractor does not work regularly for an employer, but works as and when required, during which time he or she may be subject to law of agency. The Contractors are usually paid on a freelance basis. The Contractors often work through a limited company or franchise, which they themselves own, or may work through an umbrella organization.