Difference between revisions of "Limited liability partnership"

| Line 1: | Line 1: | ||

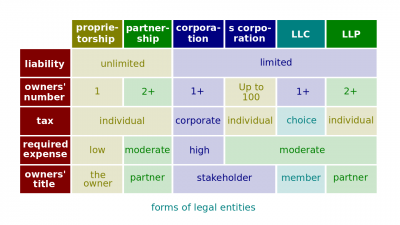

| − | [[File:Org-forms.png|400px|thumb|right|[[Legal | + | [[File:Org-forms.png|400px|thumb|right|[[Legal entity]]]][[Limited liability partnership]] (also known by its acronym, [[LLP]]) is a [[legal entity]] that combines the limited liability advantage of a corporation with the tax advantages of a partnership. |

Revision as of 10:23, 3 November 2019

Limited liability partnership (also known by its acronym, LLP) is a legal entity that combines the limited liability advantage of a corporation with the tax advantages of a partnership.

Definitions

According to Financial Management Theory and Practice by Eugene F. Brigham and Michael C. Ehrhardt (13th edition),

- Limited liability partnership (LLP). Combines the limited liability advantage of a corporation with the tax advantages of a partnership.

According to Fundamentals of Financial Management by Eugene F. Brigham and Joel F. Houston (15th edition),

- Limited liability partnership (LLP). Similar to an LLC but used for professional firms in the fields of accounting, law, and architecture. It provides personal asset protection from business debts and liabilities but is taxed as a partnership.

Related concepts

- Financial management. A combination of enterprise efforts undertaken in order to procure and utilize monetary resources of the enterprise.