Work Sellers

Work Sellers (hereinafter, the Lectio) is the second lesson part of the Employment Essentials lesson that introduces its participants to employment and related topics.

This lesson belongs to the Introduction to Employment session of the CNM Cyber Orientation. The Orientation is the second stage of the WorldOpp Pipeline.

Contents

Content

The predecessor lectio is What Employment Is.

Key terms

- Worker. Any individual who is in the business of selling his or her work time to employers. The sellers include employees, employment candidates, and pretty much every seller on the job market.

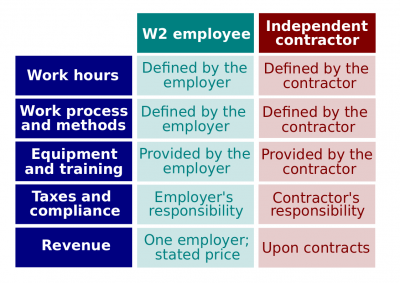

- Employee (in the United States, also known as a W2-employee). Any individual employed by an employer for some compensation that most likely includes wages or a salary.

- Independent contractor (in the United States, also known as a 1099-form worker) is a contractor, who is an individual who provides any legal entity with his or her products, usually, services. The Contractor's products are specified under terms of a contract or a verbal agreement.

- Self-employed. The state of working for oneself as a freelance or the owner of a business rather than for an employer.

- Volunteer. A person who does something, especially helping other people, willingly and without being forced or paid to do it.

- Employment candidate. Any candidate in a search for employment as an employee.

Script

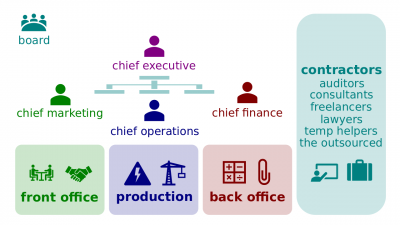

- Employees sell their work or, to be more precise, their work time, but not all workers are employees. Those workers who are not employees are either (a) self-employed or (b) volunteers.

- Self-employment is the state of working for oneself as an independent contractor, business owner, or another entrepreneur rather than for an employer.

- Independent contractors provide their customers with their products, usually, services, rather than with their work time. Unlike employees, the contractors deliver what their contract specifies and they don't need to report the customers how the work is done and when the work is done.

- The United States Internal Revenue Service, which is better known by its acronym, IRS, distinguishes employees and independent contractors for tax purposes. In the United States, employers pay taxes for the employees, while the self-employed are responsible for their own taxes.

- Those contractors who work for different organizations, rather than working all the time for a single organization are known as freelancers.

- Those who are in their search for employment are self-employed as well. No one pays them for looking for a job; they are their own employers.

- Volunteers work willingly without being forced and being paid. For instance, many CNM volunteers work without any pay because they want to help other people in career transitions. In the United States, volunteers usually work for either non-profit organizations or, if they are self-employed, for own businesses.

Student Workers is the successor lectio.

Questions

Lectio quiz

- ? --Yes/No/I'm not sure/Let me think/What is a ?

User data

- The answer is recorded for the lectio completion purposes.