Difference between revisions of "Enterprise Architecture Quarter"

(→Concepts) |

|||

| (76 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | [[Enterprise Architecture Quarter]] (hereinafter, the ''Quarter'') is the | + | [[Enterprise Architecture Quarter]] (hereinafter, the ''Quarter'') is a lecture introducing the learners to [[portfolio design]] primarily through key topics related to [[enterprise architecture]]. The ''Quarter'' is the third of four lectures of [[Portfolio Quadrivium]], which is the first of seven modules of '''[[Septem Artes Administrativi]]''' (hereinafter, the ''Course''). The ''Course'' is designed to introduce the learners to general concepts in [[business administration]], [[management]], and [[organizational behavior]]. |

| − | |||

| − | |||

| − | |||

| − | |||

==Lecture outline== | ==Lecture outline== | ||

| − | '' | + | ''[[Feasibility Study Quarter]] is the predecessor lecture. In the [[enterprise research]] series, the previous lecture is [[Enterprise Intelligence Quarter]].'' |

| + | :[[Portfolio design]] is the [[enterprise envisioning]] of the [[enterprise portfolio]]. This lecture concentrates on [[enterprise architecture]] because this ''architecture'' is the main outcome from this ''modeling''. | ||

===Concepts=== | ===Concepts=== | ||

#'''[[Enterprise architecture]]'''. A composition of the interrelated [[enterprise business|business]]es, [[process asset]]s, [[enterprise factor]]s, and [[enterprise personnel|personnel]] that together are known as an [[enterprise]]. | #'''[[Enterprise architecture]]'''. A composition of the interrelated [[enterprise business|business]]es, [[process asset]]s, [[enterprise factor]]s, and [[enterprise personnel|personnel]] that together are known as an [[enterprise]]. | ||

| − | #*[[Enterprise]]. An undertaking to create something and/or develop somebody, which takes some level of [[enterprise effort]]. In other words, an [[enterprise]] is one or more [[business]]es unified in one [[system]]. An [[enterprise]] can also refer to an [[organizational unit]], [[organization]], or collection of [[organization]]s that share [[knowledge base]]s and other [[enterprise resource]]s. | + | #*[[File:Enterprise.png|400px|thumb|right|[[Enterprise]]]][[Enterprise]]. An undertaking to create something and/or develop somebody, which takes some level of [[enterprise effort]]. In other words, an [[enterprise]] is one or more [[business]]es unified in one [[system]]. An [[enterprise]] can also refer to an [[organizational unit]], [[organization]], or collection of [[organization]]s that share [[knowledge base]]s and other [[enterprise resource]]s. |

| + | #*[[Sector]]. The market that some [[market exchangeable]] or a group of interrelated products fits into. Examples include: consumer technology, cleantech, biotech, and enterprise technology. Venture Capitalists tend to have experience investing in specific related sectors and thus tend not to invest outside of their area of expertise. | ||

#'''[[Enterprise business]]'''. The actual or potential practice of making enterprise's profit by engaging in commerce. | #'''[[Enterprise business]]'''. The actual or potential practice of making enterprise's profit by engaging in commerce. | ||

| − | #*[[Business]]. (1) An individual's regular occupation, profession, or trade; (2) | + | #*[[Business]]. (1) An individual's regular occupation, profession, or trade; (2) The practice of making one's profit by engaging in commerce. |

| − | #*[[Departmentalization]]. The basis by which jobs in an [[enterprise]] are grouped together. | + | #*[[File:Departmentalization.png|400px|thumb|right|[[Departmentalization]]]][[Departmentalization]]. The basis by which jobs in an [[enterprise]] are grouped together. |

| − | #'''[[ | + | #[[File:Efficiency-effectiveness.png|400px|thumb|right|[[Efficiency]] vs [[effectiveness]]]]'''[[Portfolio engineering]]'''. The application of scientific principles to designing and/or modifying of the [[enterprise portfolio]]. |

| − | + | #*[[Engineering]]. The creative application of science, mathematical methods, and empirical evidence to the innovation, design, construction, operation and maintenance of [[market exchangeable]]s, [[system]]s, [[process]]es, [[business]]es, and [[enterprise]]s. To simplify, [[engineering]] is the application of scientific principles to practical ends. | |

| − | # | + | #*[[Startup business]] (or, simply, [[startup business|startup]]). (1) A [[business]] in its search of its [[business model]], which usually means ways not to depend on external [[funding]]; (2) An [[enterprise]] in the early stages of operations. [[startup business|Startup]]s are usually seeking to solve a [[problem]] of fill a need, but there is no hard-and-fast rule for what makes a [[startup business|startup]] since situations differ. Often, a company is considered a [[startup business|startup]] until they stop referring to themselves as a [[startup business|startup]]. |

| − | #'''[[ | + | #*[[Operational business]]. Any [[business]], which [[business model]] generates revenue. |

| − | #*[[ | + | #'''[[Strategic business unit]]''' ([[SBU]]). A single independent [[business]] of an organization that formulates its own [[competitive strategy]]. |

| − | #*[[ | + | #*[[SBU market]]. A [[target market]] of a [[strategic business unit]] ([[SBU]]). Any [[SBU]] handles one or more [[target market]]s, which on which other [[SBU]]s of the same [[enterprise]] rarely target. |

| − | #'''[[ | + | #*[[SBU resource]]. A [[resource]] of a [[strategic business unit]] ([[SBU]]). |

| − | + | #*[[SBU business]]. A [[business]] of a [[strategic business unit]] ([[SBU]]). Any [[SBU]] handles one or more [[business]]es, but any of those shall use the same [[competitive strategy]]. | |

| − | # | + | #[[File:Porter-curve.png|400px|thumb|right|Profitability curve for [[competitive strategy|competitive strategi]]es]]'''[[Competitive strategy]]'''. A formulated [[strategy]] for how a [[strategic business unit]] is going to compete. This formulation usually states which one of four types of [[competitive strategy|competitive strategi]]es the [[strategic business unit]] is going to pursue, what it considers as its [[competitive advantage]] or [[competitive advantage|advantage]]s, defines its [[business model]], and may or may not include (a) what products, (c) resulted from what production, (d) at what price, (e) using what presentation and promotion, (f) on what [[market]] or [[market]]s with regard to the region or regions and/or segment or segments of customers, (g) with what front-end office personnel, (h) with what level of [[enterprise]]'s support this enterprise is going to offer, as well as (i) what financial results and/or competitors' actions would trigger what changes in those decisions. Rarely, a mature [[enterprise]] formulates just one [[competitive strategy]]; usually, there are several [[Competitive strategy|competitive strategi]]es in the [[enterprise portfolio]] since different [[strategic business unit]]s are supposed to have their own [[Competitive strategy|competitive strategi]]es.[[File:Competitive-strategies.png|400px|thumb|right|[[Competitive strategy|Competitive strategi]]es]] |

| + | #*[[Core competency]]. An organization's major value-creating capability that determines its competitive weapons. | ||

#*[[Competitive advantage]]. What sets an enterprise apart; its distinctive edge. | #*[[Competitive advantage]]. What sets an enterprise apart; its distinctive edge. | ||

| + | #'''[[Cost leadership strategy]]'''. The [[competitive strategy]] that strives to achieve the lowest [[cost of operation]] in the industry. The lowest cost of operation is usually driven by (a) significant [[economy of scale]], which requires a substantial [[market share]], and/or (b) [[learning curve]], which requires substantial experience in the [[operations]]. The lowest costs do not necessarily mean the lowest prices; a [[cost leadership strategy]] is about two [[competitive advantage]]s: (1) [[business opportunity|business opportuniti]]es to lower prices when and if the competition requires it and (2) maximization of the difference between [[sales]] and [[cost of operation]]. | ||

| + | #*[[Mass production]]. The production of items in large batches. | ||

| + | #*[[Mass customization]]. Providing customers with a product when, where, and how they want it. | ||

| + | #*[[Exporting]]. Making products domestically and selling them abroad. | ||

| + | #*[[Importing]]. Acquiring products made abroad and selling them domestically. | ||

| + | #'''[[Differentiation strategy]]'''. The [[competitive strategy]] that strives to charge high prices. These high prices are commonly driven by unique features (or differences) of the [[market exchangeable]] that are offered for sale on the [[market]]. [[Customer]]s usually are willing to pay high prices when [[market exchangeable]]s are uniquely desirable. | ||

| + | #*[[First mover]]. An enterprise that's first to bring a product innovation to the market or to use a new process innovation. | ||

| + | #'''[[Focus strategy]]'''. The [[competitive strategy]] that strives to offer specialized [[market exchangeable]]s on a [[niche market]]. | ||

| + | #*[[Cost focus]]. A [[focus strategy]] that strives to achieve the lowest [[cost of operation]] on the [[niche market]]. | ||

| + | #*[[Differentiation focus]]. A [[focus strategy]] that strives to charge high prices on the [[niche market]]. | ||

#'''[[Innovation]]'''. Taking [[change idea]]s and turning them into new products, product features, production methods, pricing strategies, and ways of [[enterprise administration]]. | #'''[[Innovation]]'''. Taking [[change idea]]s and turning them into new products, product features, production methods, pricing strategies, and ways of [[enterprise administration]]. | ||

#*[[Sustaining innovation]]. Small and incremental changes in established products rather than dramatic breakthroughs. | #*[[Sustaining innovation]]. Small and incremental changes in established products rather than dramatic breakthroughs. | ||

| − | #*[[Disruptive innovation]] (or [[disruption]]). [[Innovation]]s in [[ | + | #*[[Disruptive innovation]] (or [[disruption]]). [[Innovation]]s in [[market exchangeable]]s or [[process]]es that radically change existing [[market]]s including an industry's rules of the game. |

| − | #'''[[ | + | #'''[[Exit strategy]]'''. An [[enterprise strategy]] that seeks to withdraw an [[enterprise]] out of a particular [[business]] at the lowest cost and biggest gain. With regard to [[startup business]]es, this is how their founders usually get rich. An [[exit strategy]] is the method by which an investor and/or entrepreneur intends to "exit" their investment in a company. Commons options are an [[IPO]] or [[buyout]] from another company. Entrepreneurs and [[venture capitalist]]s often develop an [[exit strategy]] while the [[startup business]] is still growing. |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

#*[[Buyout]]. A common [[exit strategy]]. The purchase of a company's shares that gives the purchaser controlling interest in the company. | #*[[Buyout]]. A common [[exit strategy]]. The purchase of a company's shares that gives the purchaser controlling interest in the company. | ||

#*[[Liquidation]]. The process of dissolving a company by selling off all of its assets (making them liquid). | #*[[Liquidation]]. The process of dissolving a company by selling off all of its assets (making them liquid). | ||

| Line 47: | Line 44: | ||

===Roles=== | ===Roles=== | ||

| − | #'''[[ | + | #'''[[Enterprise architect]]'''. A practitioner of [[enterprise architecture]]. |

| − | |||

| − | |||

| − | |||

| − | |||

===Instruments=== | ===Instruments=== | ||

| − | #'''[[BCG matrix]]'''. A strategy tool that guides resource allocation decisions on the basis of market share and growth rate of [[strategic business unit]]s | + | #[[File:Bcg-matrix.png|400px|thumb|right|[[BCG matrix]]]]'''[[BCG matrix]]'''. A strategy tool that guides resource allocation decisions on the basis of market share and growth rate of [[strategic business unit]]s. |

| − | |||

===Results=== | ===Results=== | ||

| − | #'''[[Enterprise portfolio]]'''. A collection of all [[business]]es in which a particular [[enterprise]] | + | #'''[[Enterprise portfolio]]'''. A collection of all [[business]]es in which a particular [[enterprise]] operates. |

#*[[Portfolio]]. A range of investments held by a [[legal entity]], an individual or organization. | #*[[Portfolio]]. A range of investments held by a [[legal entity]], an individual or organization. | ||

| + | #'''[[Enterprise strategy]]'''. The plan for how the [[enterprise]] will engage or keep engaged in one or more [[business]]es, how it will do what it's in business to do, how it will compete successfully, and how it will attract and satisfy its customers in order to achieve its goals. An [[enterprise strategy]] for a separate business of the [[enterprise]] is called [[business strategy]]. An [[enterprise strategy]] for a separate unit of the enterprise, known as [[strategic business unit]], is called [[competitive strategy]]. | ||

===Practices=== | ===Practices=== | ||

| − | '' | + | ''[[Concept Management Quarter]] is the successor lecture. In the [[enterprise envisioning]] series, the next lecture is [[Business Modeling Quarter]].'' |

==Materials== | ==Materials== | ||

| Line 72: | Line 65: | ||

==See also== | ==See also== | ||

| + | |||

| + | [[Category:Septem Artes Administrativi]][[Category:Lecture notes]] | ||

Latest revision as of 13:34, 6 May 2023

Enterprise Architecture Quarter (hereinafter, the Quarter) is a lecture introducing the learners to portfolio design primarily through key topics related to enterprise architecture. The Quarter is the third of four lectures of Portfolio Quadrivium, which is the first of seven modules of Septem Artes Administrativi (hereinafter, the Course). The Course is designed to introduce the learners to general concepts in business administration, management, and organizational behavior.

Contents

Lecture outline

Feasibility Study Quarter is the predecessor lecture. In the enterprise research series, the previous lecture is Enterprise Intelligence Quarter.

- Portfolio design is the enterprise envisioning of the enterprise portfolio. This lecture concentrates on enterprise architecture because this architecture is the main outcome from this modeling.

Concepts

- Enterprise architecture. A composition of the interrelated businesses, process assets, enterprise factors, and personnel that together are known as an enterprise.

- Enterprise. An undertaking to create something and/or develop somebody, which takes some level of enterprise effort. In other words, an enterprise is one or more businesses unified in one system. An enterprise can also refer to an organizational unit, organization, or collection of organizations that share knowledge bases and other enterprise resources.

- Sector. The market that some market exchangeable or a group of interrelated products fits into. Examples include: consumer technology, cleantech, biotech, and enterprise technology. Venture Capitalists tend to have experience investing in specific related sectors and thus tend not to invest outside of their area of expertise.

- Enterprise business. The actual or potential practice of making enterprise's profit by engaging in commerce.

- Business. (1) An individual's regular occupation, profession, or trade; (2) The practice of making one's profit by engaging in commerce.

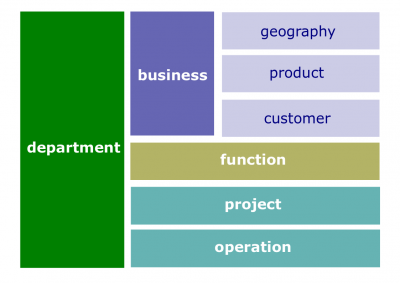

- Departmentalization. The basis by which jobs in an enterprise are grouped together.

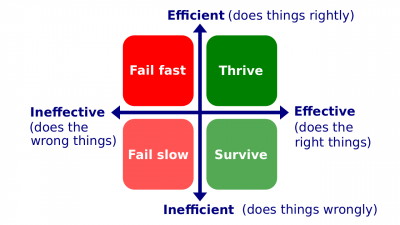

- Portfolio engineering. The application of scientific principles to designing and/or modifying of the enterprise portfolio.

- Engineering. The creative application of science, mathematical methods, and empirical evidence to the innovation, design, construction, operation and maintenance of market exchangeables, systems, processes, businesses, and enterprises. To simplify, engineering is the application of scientific principles to practical ends.

- Startup business (or, simply, startup). (1) A business in its search of its business model, which usually means ways not to depend on external funding; (2) An enterprise in the early stages of operations. Startups are usually seeking to solve a problem of fill a need, but there is no hard-and-fast rule for what makes a startup since situations differ. Often, a company is considered a startup until they stop referring to themselves as a startup.

- Operational business. Any business, which business model generates revenue.

- Strategic business unit (SBU). A single independent business of an organization that formulates its own competitive strategy.

- SBU market. A target market of a strategic business unit (SBU). Any SBU handles one or more target markets, which on which other SBUs of the same enterprise rarely target.

- SBU resource. A resource of a strategic business unit (SBU).

- SBU business. A business of a strategic business unit (SBU). Any SBU handles one or more businesses, but any of those shall use the same competitive strategy.

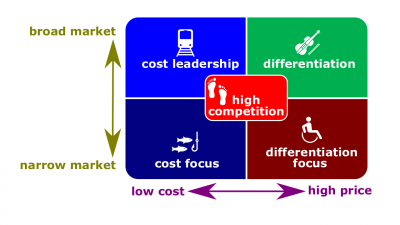

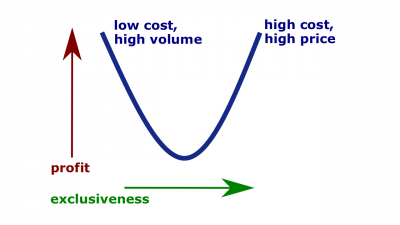

- Competitive strategy. A formulated strategy for how a strategic business unit is going to compete. This formulation usually states which one of four types of competitive strategies the strategic business unit is going to pursue, what it considers as its competitive advantage or advantages, defines its business model, and may or may not include (a) what products, (c) resulted from what production, (d) at what price, (e) using what presentation and promotion, (f) on what market or markets with regard to the region or regions and/or segment or segments of customers, (g) with what front-end office personnel, (h) with what level of enterprise's support this enterprise is going to offer, as well as (i) what financial results and/or competitors' actions would trigger what changes in those decisions. Rarely, a mature enterprise formulates just one competitive strategy; usually, there are several competitive strategies in the enterprise portfolio since different strategic business units are supposed to have their own competitive strategies.

Profitability curve for competitive strategies

Profitability curve for competitive strategies- Core competency. An organization's major value-creating capability that determines its competitive weapons.

- Competitive advantage. What sets an enterprise apart; its distinctive edge.

- Cost leadership strategy. The competitive strategy that strives to achieve the lowest cost of operation in the industry. The lowest cost of operation is usually driven by (a) significant economy of scale, which requires a substantial market share, and/or (b) learning curve, which requires substantial experience in the operations. The lowest costs do not necessarily mean the lowest prices; a cost leadership strategy is about two competitive advantages: (1) business opportunities to lower prices when and if the competition requires it and (2) maximization of the difference between sales and cost of operation.

- Mass production. The production of items in large batches.

- Mass customization. Providing customers with a product when, where, and how they want it.

- Exporting. Making products domestically and selling them abroad.

- Importing. Acquiring products made abroad and selling them domestically.

- Differentiation strategy. The competitive strategy that strives to charge high prices. These high prices are commonly driven by unique features (or differences) of the market exchangeable that are offered for sale on the market. Customers usually are willing to pay high prices when market exchangeables are uniquely desirable.

- First mover. An enterprise that's first to bring a product innovation to the market or to use a new process innovation.

- Focus strategy. The competitive strategy that strives to offer specialized market exchangeables on a niche market.

- Cost focus. A focus strategy that strives to achieve the lowest cost of operation on the niche market.

- Differentiation focus. A focus strategy that strives to charge high prices on the niche market.

- Innovation. Taking change ideas and turning them into new products, product features, production methods, pricing strategies, and ways of enterprise administration.

- Sustaining innovation. Small and incremental changes in established products rather than dramatic breakthroughs.

- Disruptive innovation (or disruption). Innovations in market exchangeables or processes that radically change existing markets including an industry's rules of the game.

- Exit strategy. An enterprise strategy that seeks to withdraw an enterprise out of a particular business at the lowest cost and biggest gain. With regard to startup businesses, this is how their founders usually get rich. An exit strategy is the method by which an investor and/or entrepreneur intends to "exit" their investment in a company. Commons options are an IPO or buyout from another company. Entrepreneurs and venture capitalists often develop an exit strategy while the startup business is still growing.

- Buyout. A common exit strategy. The purchase of a company's shares that gives the purchaser controlling interest in the company.

- Liquidation. The process of dissolving a company by selling off all of its assets (making them liquid).

- IPO. Initial public offering. The first time shares of stock in a company are offered on a securities exchange or to the general public. At this point, a private company turns into a public company (and is no longer a startup).

- Harvesting. Exiting a venture when an entrepreneur hopes to capitalize financially on the investment in the future.

Roles

- Enterprise architect. A practitioner of enterprise architecture.

Instruments

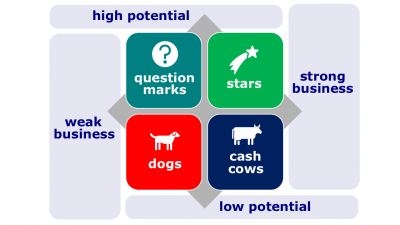

- BCG matrix. A strategy tool that guides resource allocation decisions on the basis of market share and growth rate of strategic business units.

Results

- Enterprise portfolio. A collection of all businesses in which a particular enterprise operates.

- Portfolio. A range of investments held by a legal entity, an individual or organization.

- Enterprise strategy. The plan for how the enterprise will engage or keep engaged in one or more businesses, how it will do what it's in business to do, how it will compete successfully, and how it will attract and satisfy its customers in order to achieve its goals. An enterprise strategy for a separate business of the enterprise is called business strategy. An enterprise strategy for a separate unit of the enterprise, known as strategic business unit, is called competitive strategy.

Practices

Concept Management Quarter is the successor lecture. In the enterprise envisioning series, the next lecture is Business Modeling Quarter.